Family Defender®

Say 'No' to Expensive Attorney Fees

Who is Covered

Member, Spouse/Partner, and unmarried dependents up to age 26 are covered for all their personal legal needs.

Individual coverage only is also available.

Covered services include, but are not limited to:

↓Civil Law

- Plaintiff or Defendant

- Administrative Hearings

- Trial Coverage up to $15,000

- Small Claims

- Name Change

- Civil Injunctions

- Landlord/Tenant Matters as Tenant

↓Family Law*+

- Uncontested Divorce

- Contested Divorce

- Annulments

- Spousal Support

- Paternity Action

- Child Support/Custody

- Post-Decree Enforcement Action

- Post-Decree Modification Action

- Equitable Distribution of Marital Assets

↓Other Family Law

- Pre/Postnuptial Agreements

- Domestic Adoption

- Domestic Violence

- Elder Law Matters

↓Immigration

- Visa Extension

- Naturalization

- Deportation (Removal)

↓Traffic Violations

- Moving Traffic Violations

- First Offense DUI

- License Revocation & Suspension

↓Criminal Law

- Misdemeanor Defense

- Juvenile Defense

- Habeas Corpus

- Trial Coverage up to $15,000

↓Consumer-Seller Protection

- Consumer Protection Matters

- Personal Property Protection

- Trial Coverage up to $15,000

↓Contingency Matters**

- Personal Injury

- Auto Accidents

- Slip and Fall

- Medical Malpractice

↓Document Prep/Review

- Demand Letters

- Quit Claim Deeds

- Personal Affidavit

- Promissory Note

- Bill of Sale

- Personal Contract

- Lease Agreement

↓Real Estate Transactions

- Review and/or Preparation of Purchase

- Agreement, Mortgage, and Deed

- Purchase of Primary/Secondary Residence

- Sale of Primary/Secondary Residence

- Refinancing of Primary/Secondary Residence

- Attorney Attendance at Closing

- Real Estate Disputes

- Neighbor Disputes

↓Estate Planning

- Living Will

- Powers of Attorney

- Wills & Testamentary Trusts for Minors

- Codicils

- Estate Administration/Probate

- Uncontested Guardianship or

- Conservatorship

↓Financial Matters

- Debt Collection

- Garnishment Defense

- IRS Audit Protection

- Foreclosure+

- Limiting Creditor Harassment

- Ch. 7 & 13 Bankruptcy+

↓Other Legal Matters

- Insurance Law

- Standard Business Incorporation

↓Added Value Services

- Online Legal Library

- DIY Legal Documents

- 24/7 Emergency Line

- Financial Coaching

- Tax Coaching

- Discounted Tax Return Preparation

- Mobile App

- Identity Theft Restoration Program

*Contested matters subject to 12-hour limitation, discount thereafter.

**First $1,000 exempt from fee. Subject to State and Federal Statutes.

+Subject to 120-day waiting period

- No Deductibles

- No Co-Pays

- No Claim Forms

Eligibility Requirements for Spouse/Dependents

For a Spouse [formal marriage or common law], Domestic Partner or Child to be added as a Dependent, their last name must match that of the Policyholder. If your last names do not match, supporting documentation is required to verify eligibility.

- Spouse: Copy of marriage certificate is required.

- Common Law Spouse: State must recognize Common Law Marriage. Additional documentation may be required according to state statutes, which may include but not be limited to copies of joint federal income tax returns, proof of employer provided medical insurance, or other employer provided spousal benefit.

- Domestic Partnership: Proof of State or local jurisdiction registration is required where recognized. In those states where Domestic Partnership is not recognized, proof of employer provided health insurance or other spousal benefits provided by Member’s employer is required.

- Children: Copy of birth certificate is required.

Attorney’s fees are paid in full for all covered legal matters when you utilize a Network Attorney. Receive a 33.3% discount off attorney’s fees for pre-existing and other non-excluded legal matters. Coverage does not include fines, court costs, or other incidentals relating to the legal matter. Out-of-network benefits available.

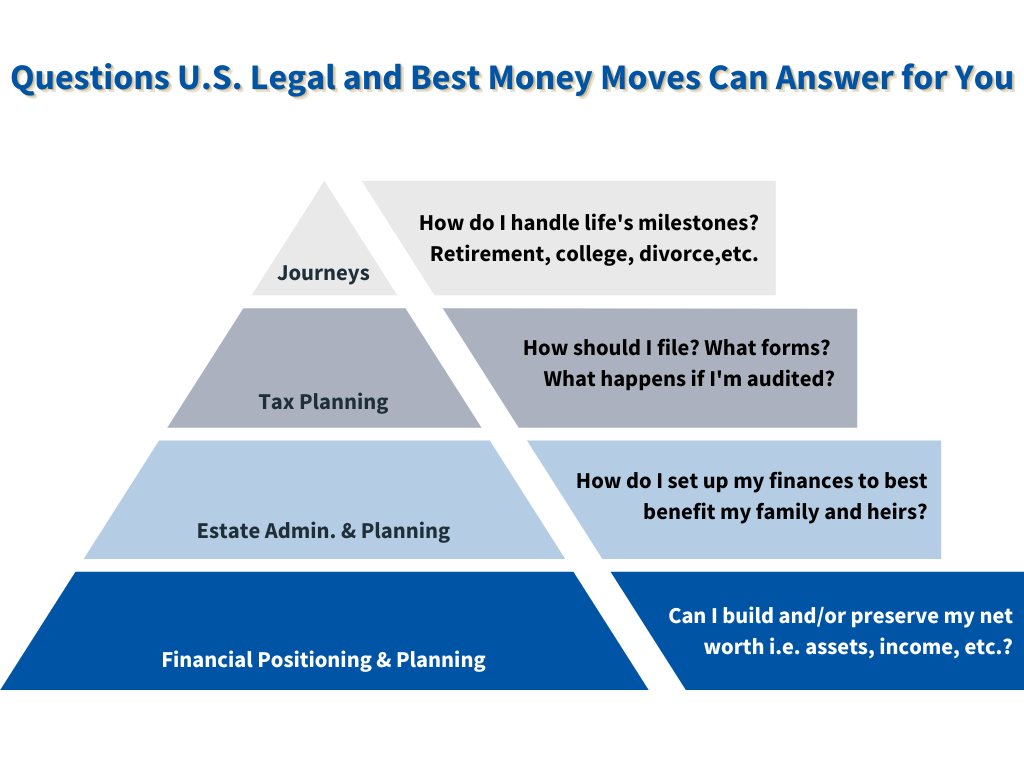

Financial Wellness Suite

Benefit offered to Family Defender Members

Now powered by

Best Money Moves is an award-winning financial wellness platform that works with your legal plan to help you make better decisions about your money.

Your personal Money Coach works directly with you on the following:

- Personal Tax Return Preparation (State and Federal tax form preparation for $195)

- Unlimited telephone and email advice and consultation on federal tax matters

- Free review of your prior year’s tax return

- Professional, unbiased, confidential, trustworthy

- Certified experts in budgeting, debt management, financial planning, and more

- No sales environment – focus on helping you with financial goals, challenges, and life events

- Help increase savings, lower debts, improve credit, and decrease financial stress

- Telephonic consultations to save you time and money

- 3-5 minute comprehensive financial wellness assessment

- Book a telephone or Zoom meeting with a financial professional to review your assessment, questions and concerns

- Review tailored education based on your individual assessment plus, group webinars hosted and other educational opportunities

- Financial planning resources for major life events including, income, investment, tax, healthcare, legacy and estate, and retirement planning

- 1,000+ pieces of written and video content

- Interactive journeys, tools and calculators

- Budgeting module that helps you set savings goals

- Webinars with money experts let you ask your questions

Your Financial Wellness Suite Dashboard

The Best Money Moves interactive dashboard makes it easier than ever to help you on your journey to financial freedom.

- Easily access with single sign on (SSO) through your USL Member Portal

- Confidential online interaction with your Financial Crisis Manager

- Privacy Promise – personal information is NEVER shared or sold

- Track your financial well-being score over time and review personalized content, resources, and tools based on your unique interactions within the dashboard

Identity Defender®

Protect your Money and Your Reputation

Provided in collaboration with

Covered services include, but are not limited to:

↓Credit

- Instant Credit Inquiry Alerts

- 1 Bureau Credit Report Monitoring

- 1 Bureau Quarterly Credit Report & Score

- Credit Score Simulator

- Monthly Credit Score Tracker

- Manage Credit Freeze

↓Monitoring (Dark Web)

- Compromised Credentials

- Account Takeover (including mortgage inquiries, credit application, collections, etc.)

- Address

- Bank Account Number

- Debit Card Account

- Credit Card Account

- Driver's License

- Medical Insurance ID

- Passport Number

- Phone Number

- Social Security Number

↓Social Media

- Inappropriate Activity

- Hacked Account

- Impersonation Accounts

- Scams, Malware and Phishing

↓Mobile App

- Two-Factor Authentication

- Apple and Android

- Mobile Attack Control

- Mobile VPN

↓Fraud

- Fraud Alert Reminders

- Identity Threat Alerts

- Medical ID Fraud Protection

- Change of Address Monitoring

- Court Records Monitoring

- Smart SSN Tracker

↓Recover

- Lost Wallet Protection

- Fully Managed Identity Restoration (including home mortgage and title fraud)

- Restoration for Pre-Existing Identity Theft

- Ransomware Resolution

- $25K Ransomware Reimbursement

- $1 Million Identity Theft Insurance

↓Support

- 24/7 U.S. Customer Support

- Online Resources: Forms, Calculators, and Other Tools

- Junk Mail Opt Out

- Solicitation Call Opt Out

How to Enroll

Enrollment must take place in PayCom Portal. If you have any questions regarding PayCom, please contact your Human Resources Department.

Resources

Pricing

Family & Identity Defender® - Individual

$18.75 per month

Family & Identity Defender® - Family

$20.00 per month

Identity Defender® - Family or Individual

$9.95 per month

Once you enroll in coverage, you will receive a certificate/plan document(s) describing the exact coverage benefit purchased. This page explains the general purposes of the plans, but in no way changes or affects the plans afforded under the policy/plan issued. All coverage is to be subject to actual policy/plan conditions and exclusions. Not sponsored or approved by the United States Government or any Department or Agency thereof.

Ask Us Anything

Contact Us

- 8133 Baymeadow Way, Jacksonville, FL 32256

- info@uslegalservices.net

- (800) 356-LAWS (5297)